BTC, ETH rally on Wednesday as Fed meeting nears

Bitcoin rebounded from Tuesday's losses as all market focus turned to today's Federal Reserve interest rate decision. The market widely expects the Fed to raise rates by 25 basis points at its May meeting. Ether also moved higher, approaching $1,900 in the process.

Bitcoin

Bitcoin (BTC) rallied on Wednesday as all market focus turned to today's Federal Reserve interest rate decision.

Following Tuesday's low of $27,935.73, BTC/USD surged to an intraday high earlier in the day.

spiked to an intraday high of $28,881.30 some time earlier in the day.

This comes after Bitcoin refused to break its long-term bottom of $27,600 at the start of the week.

Overall, momentum has picked up slightly as the 10-day (red) moving average approaches its 25-day (blue) moving average.

If this upward crossover occurs, it could be a sign that the bulls need to ramp up the pressure and possibly bring BTC back above $30,000.

In order for this to happen, the Relative Strength Index (RSI) would first need to break above the upper 52.00 barrier.

Ethereum

In addition to BTC, Ether (ETH ) also rallied on the hump day as bulls started to re-enter the market.

ETH/USD rose to a high of 1,879.76 on Wednesday after almost falling below $1,800 the day before.

The move saw Ether bulls briefly push the price up to a ceiling of $1,875 before falling back as the trading day matured.

Earlier gains were tempered as price strength failed to break through the key resistance level at 48.00, with the index now tracking at 46.99.

Nonetheless, there is still optimism that Ether could break $1,900 later today once a rate decision is made.

Related Article

-

Bitcoin Brief Development History and Future Trends

-

Bitcoin Woods: Bitcoin Halves With Less Than 50,000 Blocks Left

-

A quarter out of $2.2 billion BTC, Twitter's former CEO of the company how to "muffled earnings"?

-

The Fed is done raising rates, U.S. stocks will rise Bitcoin has a "real problem"

-

From Meme to Encryption: Exploring the Evolution and Risk Challenges of PEPE

-

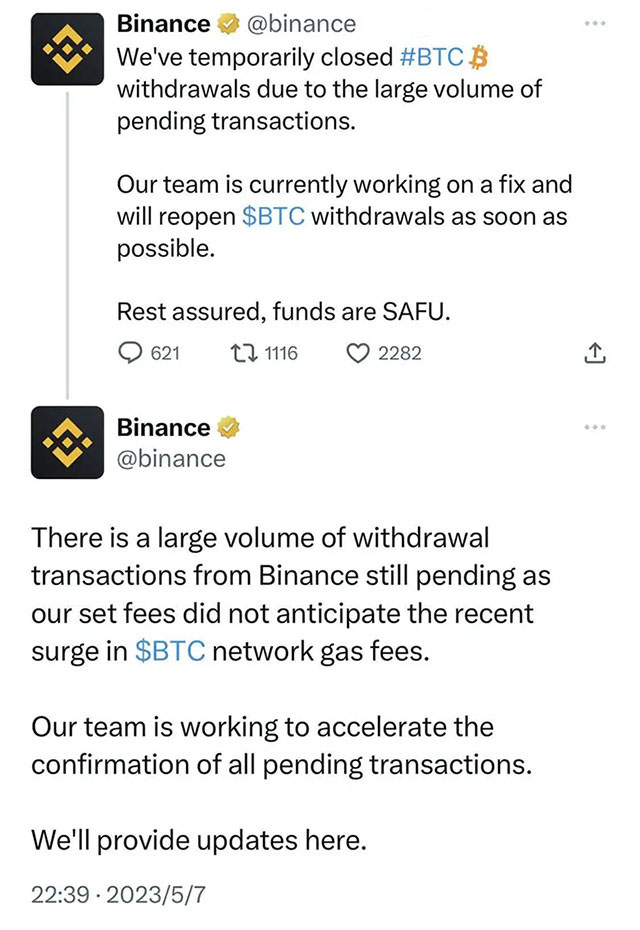

Coin Security Suspends Bitcoin Withdrawals Twice in One Day Due to Huge Coin Withdrawal Transactions