A quarter out of $2.2 billion BTC, Twitter's former CEO of the company how to "muffled earnings"?

Not long ago, Block (formerly Square), the payments company founded by former Twitter CEO Jack Dorsey, released its Q1 2023 results, selling $2.2 billion worth of bitcoin in the quarter, up 25% year-over-year, with gross profits of $1.71 billion, up 32% year-over-year, including $931 million in gross profits from the Cash App.

On that level alone, Block is a gold-drawer, as Tether, the 'layman's representative', reported audited net profits of $1.48 billion for the quarter, while Coinbase reported a net loss of $79 million on revenue of $773 million for the quarter.

So compared to the commonly reported Tether and Coinbase, is Block really another example of the crypto world 'making a fortune'?

01 What is Block?

Block (formerly known as Square) is another company founded by Jack Dorsey, the former CEO of Twitter, with two main business components: the Square ecosystem for merchants, and the Cash App e-wallet ecosystem for individuals.

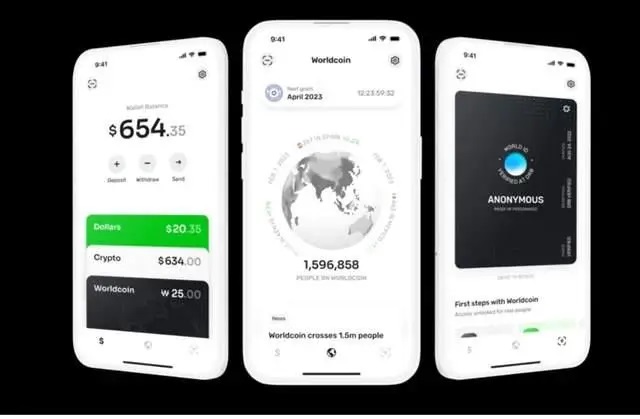

Cash App (formerly Square Cash) is a mobile payment service developed by Square that allows users to transfer funds using a mobile app and will support bitcoin from 2018, so Block's core business regarding bitcoin is the responsibility of the Cash App segment.

The Cash App buys bitcoins and makes money by selling them to users, while users can also sell bitcoins on the Cash App and deposit the amount they get from selling bitcoins into their bank accounts or debit cards.

Bitcoin generated $65.5 million in revenue for Square in the first quarter of 2019, and not only is it actively embracing bitcoin in its products and services, but Block also bowed to Hold in October 2020, making its first $50 million purchase investment in bitcoin.

Block has since invested in Bitcoin several more times, and revealed in its Q4 2020 earnings statement that it had added another $170 million in Bitcoin to its holdings.

Since Jack Dorsey has always been a 'known veteran' of the Bitcoin community and pretty much the strongest supporter of Bitcoin among the traditional internet elite, Block can be seen as basically a 'believer' who will not sell easily in the short to medium term ' (Block was also founded during his mid-term absence from Twitter, and Jack is now focusing more of his career on crypto assets and Block after leaving Twitter).

In a March 2021 interview with Fortune magazine, the company's CFO Amrita Ahuja said that there is absolutely a reason for every company to have bitcoin on its balance sheet in the future, while reiterating Block's commitment to holding bitcoin for the long term.

It's worth noting that Bob Lee, the former CTO of Square and founder of the Cash App, was the subject of the April stabbing death of a wealthy man in San Francisco that raised eyebrows in the crypto world and tech industry.

02 Did Bitcoin help Cash App make a lot of money?

Let's break down Cash App's business. It's based on free P2P transfers between individuals, and extends to C2B payments, co-branded bank cards, installment shopping (Afterpay), stock investments (no fees), and bitcoin business.

So while we mentioned at the beginning of the article that Cash App sold $2.2 billion worth of bitcoin in the quarter, up 25% year-over-year, it may seem like the bitcoin business was a big part of that.

But when you look at it more closely, the quarterly gross profit was $931 million, and excluding the bitcoin business, the Cash App segment still reported revenue of $1.1 billion, a 52% year-over-year increase, and gross profit of $880 million, which was also higher than the $840 million expected by the market.

This means that the quarterly gross profit from the Bitcoin business to Cash App was only about $50 million, which is almost negligible, and the growth rate contribution was almost negligible, making it still a marginal business.

Source: Longbridge Dolphin Investment Research Source: Longbridge Dolphin Investment Research

And because Cash App acts as a market maker, acting directly as a counterparty to users, buying and selling bitcoins from them (rather than a trading platform that aggregates sales and purchases between different users), it actually records the total price of selling bitcoins to users (rather than the spread) as revenue and the price of buying bitcoins as a cost.

That also results in Block's earnings reporting recording the total purchase and sale of bitcoin as revenue (rather than net spread), so the revenue size of the bitcoin business is pretty much tied to the volatility of the crypto secondary market, which not only seems large (other revenue is mostly net commission-based), but is also highly volatile.

So even though it's not a core business, Block's revenue and gross margins in this segment are picking up in the first quarter of the year as the secondary market for bitcoin has picked up steam, while other new businesses are seeing lower gross margins.

Overall, for both Cash App and Block, Bitcoin-related businesses account for nearly half of revenue, but gross margins are extremely low and remain a marginal innovation business.

In addition, in March this year, short-seller Hindenburg issued a 'short report' on Block, stating that Jack Dorsey's payment service provider Block (formerly Square) 'misled investors' by inflating the true number of Block's shares plummeted as a result, and the matter is still in limbo.

Of course this is not the first time Hindenburg has taken on the crypto industry, having previously taken on Tether - at the end of 2021, when the global market capitalization of crypto assets reached an all-time high of $3 trillion, Hindenburg announced a $1 million reward for 'information about the stablecoin Tether Previously undisclosed details', but Tether is still going strong.

03 Summary

Block is also a real 'Holder' in terms of direct investment in Bitcoin:

As of March 31, Block's fair value of its bitcoin holdings was $229 million, compared to the $126 million recognized on its balance sheet, according to its earnings report.

Combined with previous public information, it is speculated that Block's holdings of bitcoin are still estimated to be around 8,207 and have never been sold, with a position costing around $27,407. At the current market price of around $27,150, the position is still basically near the break-even point after years of ownership.

But perhaps the bigger picture is not here, as Jack, a 'bitcoin veteran', has provided a convenient portal for more than 40 million U.S. users to hold and interact with crypto assets, despite the fact that its Block's bitcoin business accounts for a negligible percentage of revenue (though Block has said the company does not intend to offer users access to crypto assets other than bitcoin).

Especially in today's chilly market environment, the contribution that sticking to the edge has made to the popularity of crypto payments is admirable, even if it doesn't attract more and more incremental new users.

Related Article

-

Bitcoin Brief Development History and Future Trends

-

What are the application scenarios of AI combined with blockchain?

-

Bitcoin Woods: Bitcoin Halves With Less Than 50,000 Blocks Left

-

The Fed is done raising rates, U.S. stocks will rise Bitcoin has a "real problem"

-

Another industry disruption? The "father of ChatGPT" project is expected to receive further funding

-

Certif-ID digitizes talent acquisition process with blockchain, secures €1.6 million in funding