Bitcoin Brief Development History and Future Trends

Bitcoin is an innovative and controversial digital currency that currently has a very large number of investors around the world and has quite a few trading and investment properties.

The history of Bitcoin can be traced back to October 2008, when a mysterious figure named Satoshi Nakamoto published a post on a crypto-punk forum, which is considered to be the white paper for Bitcoin. Satoshi Nakamoto then released the first version of Bitcoin's code in November 2008, and in January 2009, Satoshi Nakamoto mined Bitcoin's first block, the Genesis block, and the Bitcoin network was officially up and running.

In the development of money, there was no money in the early days of human society, and trade between tribes was barter. As the economy and trade developed, shells and the like appeared as currency, and then due to advances in metal smelting technology, there was money cast in copper and iron, eventually falling to precious metals such as gold and silver. As the economy continued to develop, paper money appeared, and the world's earliest paper money, the jiaozi, appeared in China during the Song Dynasty. The issuance of paper money was led by the government and was also known as fiat money. With the development of computer technology, paper money became electronic.

Bitcoin, as a digital currency, is different from electronic money in that it does not require a centralized trust institution like a bank and is issued and circulated through a global P2P network. Bitcoin solves the problem of clearing and settling transactions after the electronicization of cash through blockchain technology, whose blockchain is a kind of chain database storing the entire ledger, which is tamper-proof and double-flower-proof through cryptographic theory.

Looking at the current state of the market for Bitcoin, its market capitalization has reached about $800 billion, dominating the global cryptocurrency market. However, the price has been volatile, reaching a high of $40,000 and a low of $35,000 in the past month. In terms of long-term trends, the price has shown a steady increase.

In terms of future trends, as blockchain technology continues to develop and innovate, Bitcoin's transaction speed and security are expected to further improve, and more effective scaling solutions, such as the Lightning Network, may emerge. At the same time, the Bitcoin network will further support the development of smart contracts and decentralized applications, enriching its application scenarios. However, Bitcoin also faces many challenges, such as compliance issues due to policy differences between countries, restrictions imposed by anti-money laundering and anti-terrorist financing regulations, and the emergence of competing coins.

In short, the development of Bitcoin is full of uncertainties and challenges, but also contains great opportunities and potential.

Related Article

-

Bitcoin Woods: Bitcoin Halves With Less Than 50,000 Blocks Left

-

A quarter out of $2.2 billion BTC, Twitter's former CEO of the company how to "muffled earnings"?

-

The Fed is done raising rates, U.S. stocks will rise Bitcoin has a "real problem"

-

From Meme to Encryption: Exploring the Evolution and Risk Challenges of PEPE

-

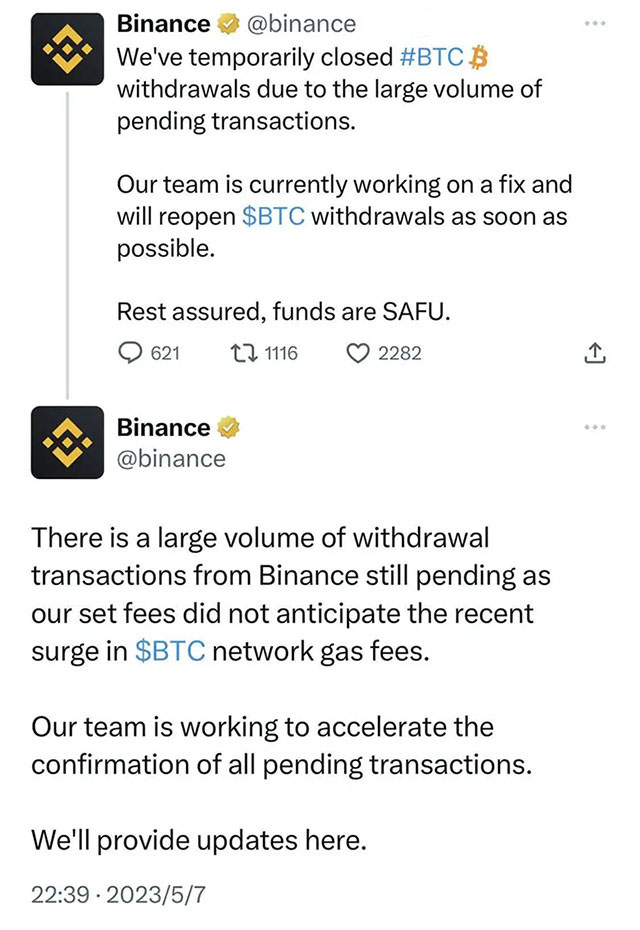

Coin Security Suspends Bitcoin Withdrawals Twice in One Day Due to Huge Coin Withdrawal Transactions

-

Ether on track to overtake Bitcoin? The emergence of BRC20 may bring a tug-of-war