The Fed is done raising rates, U.S. stocks will rise Bitcoin has a "real problem"

Billionaire hedge fund manager Paul Tudor Jones (Paul Tudor Jones) believes the Federal Reserve has finished its inflation-fighting rate hikes and that stocks will likely continue to move higher this year.

"I definitely think they're done," Jones said Monday (May 15) of the Fed's rate-hike campaign. "They'll probably declare victory now because if you look at the Consumer Price Index (CPI), it's been down for 12 straight months . ... That's never happened before in history."

Since March 2022, the Fed has raised rates 10 times, adjusting the federal funds rate to a target range of 5%-5.25%, the highest level since August 2007. The Consumer Price Index has cooled sharply since peaking at around 9% in June 2022. The index fell to 4.9% in April.

The long-term investor said the current market pattern is similar to that of mid-2006 before the global financial crisis, when stocks rose for more than a year after the Federal Reserve stopped tightening monetary policy.

"Stock prices ...... I think prices will continue to rise this year." "I'm not very optimistic because I think it's going to be a slow process."

In the short term, the investor said, the market will experience some indigestion due to the battle over the U.S. debt ceiling, and he will buy amid political turmoil.

Jones shot to fame for predicting and profiting from the 1987 stock market crash. He is also chairman of Just Capital, a nonprofit that ranks U.S. public companies based on social and environmental indicators.

He believes that after a particularly dull period of trading activity, there is a lot of dry powder ready to be put to use.

According to Jones, "We don't have an IPO planned, we don't have a plan for an additional issue at a valuation of 19, but no one is rushing to go public, and clearly something has changed within the stock market." "From a liquidity perspective, that's constructive."

Jones is predicting a multi-year trading range much like his billionaire counterpart Stan Druckenmiller. He agrees with the Duquesne Family Office founder that artificial intelligence will lead to a market split with big winners and big losers.

He said:I do think that the introduction of large language models and artificial intelligence will lead to productivity gains that have been rare in the last 75 years." He added that this could increase output by 1.5% per year over the next five years.

As for the recent heated speculation on the U.S. debt ceiling, Jones used an analogy to express his view, mentioning that he welcomed his first granddaughter about three weeks ago and that little babies often spit up after drinking milk, much like the debt ceiling issue. The political battle over the debt ceiling may stir up a risk premium and there will be some "indigestion" in the market. But think about a month later, when the matter is resolved, the risk premium will disappear again, so Tudor tend to buy low during the market turmoil.

Very interestingly, he also admitted that he actually had a different view on inflation, the stock market outlook and a host of other issues six months ago than he does now, precisely because of the rise of generative AI.

Jones said that AI will give rise to a rare productivity spurt in recent decades, in accordance with the experience of the human post-World War II "productivity miracle", similar to the post-World War II infrastructure, personal computers, the Internet, large language models may bring (annual) 1.5% productivity gains in the next five years. If this prediction comes true, the historical "productivity miracles" have been associated with rising stocks and falling inflation.

Jones: Bitcoin in trouble in the U.S.

Jones said bitcoin (BTC) has become less attractive as the regulatory situation in the U.S. has become unfriendly, and he expects inflation to decrease in the future.

"Bitcoin has a real problem because in the U.S., the whole regulatory apparatus is against it," Jones said on CNBC's Squawk Box program.

Jones, who has previously praised bitcoin's appeal as an inflation hedge, added that he believes inflation will continue to fall, adding to the cryptocurrency's less-than-optimistic outlook.

Following the events of 2022, U.S. regulators have become tougher on the crypto industry with the dramatic collapse of FTX in November, such as the Securities and Exchange Commission (SEC) threatening legal action against Coinbase, a publicly traded cryptocurrency exchange.

The hedge fund manager's comments suggest that he has cooled his stance on bitcoin since 2020 when he said he might allocate 5% of his assets to bitcoin in the face of the Federal Reserve's currency devaluation.

However, last October, Jones called his allocation to bitcoin "secondary," saying that cash is a worthwhile investment as long as people believe the Fed can control inflation.

Related Article

-

Bitcoin Brief Development History and Future Trends

-

Bitcoin Woods: Bitcoin Halves With Less Than 50,000 Blocks Left

-

A quarter out of $2.2 billion BTC, Twitter's former CEO of the company how to "muffled earnings"?

-

From Meme to Encryption: Exploring the Evolution and Risk Challenges of PEPE

-

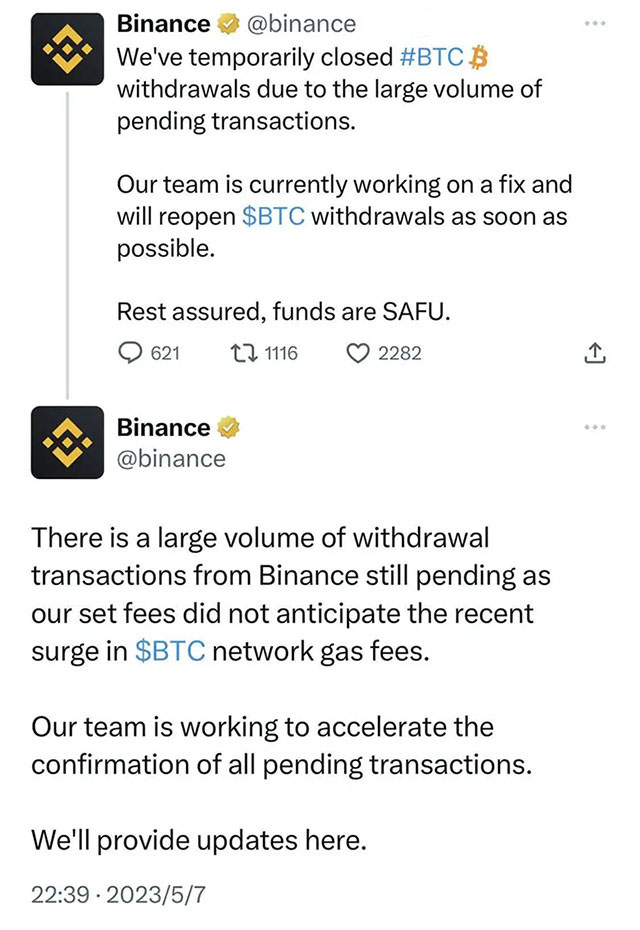

Coin Security Suspends Bitcoin Withdrawals Twice in One Day Due to Huge Coin Withdrawal Transactions

-

Ether on track to overtake Bitcoin? The emergence of BRC20 may bring a tug-of-war