Bitcoin Introduction Overview and Development History

Bitcoin is the earliest digital currency, based on blockchain and distributed data technology, which has led the rapid development of digital currencies for more than 10 years. Some people see it as a new investment opportunity, others see it as a flooding beast. But it is a very objective fact that it is indeed currently circulating and being used in many places around the world. So what is Bitcoin, and how has it evolved? Let's follow eaiot to find out!

I. Bitcoin Introduction Overview

The concept of Bitcoin was first proposed by Satoshi Nakamoto on November 1, 2008, and was officially born on January 3, 2009.

The open-source software was designed and released based on Satoshi Nakamoto's ideas and the P2P network on which it is built. Bitcoin is a P2P form of digital currency. Bitcoin's transaction records are open and transparent. Peer-to-peer transmission means a decentralized payment system.

Unlike most currencies, Bitcoin is not issued by a specific monetary institution, it is generated by a large number of calculations based on a specific algorithm, and the Bitcoin economy uses a distributed database of nodes throughout the P2P network to confirm and record all transactions, and a cryptographic design to ensure the security of all aspects of the currency's circulation. The decentralized nature of P2P and the algorithms themselves ensure that there is no artificial manipulation of the value of the currency through mass production of bitcoins. The cryptography-based design allows bitcoins to be transferred or paid only by the real owner. This also ensures the anonymity of the currency ownership and circulation transactions. The total number of bitcoins is limited, with the cryptocurrency system having no more than 10.5 million for four years, after which the total number will be permanently limited to 21 million.

II. Bitcoin development history

The global financial crisis broke out in 2008, and on November 1 of that year, a man calling himself Satoshi Nakamoto published a white paper on the P2P foundation website, "Bitcoin: A Peer-to-Peer Electronic Cash System," stating his new vision for electronic money. -On January 3, 2009, the Bitcoin Genesis block was born.

In contrast to fiat currency, Bitcoin does not have a centralized issuer, but is generated by the calculations of network nodes. Anyone can participate in the creation of Bitcoin, and it can be circulated worldwide, bought and sold on any computer with Internet access, and anyone can mine, buy, sell, or receive Bitcoin no matter where they are, and no one can identify the user during the transaction. 2009 On January 5, 2009, Bitcoin, which is not controlled by central banks or any financial institutions, was born. Bitcoin is a digital currency consisting of a complex string of computer-generated code, and new bitcoins are manufactured through a predetermined process.

Whenever Bitcoin enters the mainstream media, the mainstream media always asks some mainstream economist to analyze Bitcoin. Earlier, these analyses always focused on whether Bitcoin was a scam or not. Nowadays, the analysis always focuses on whether bitcoin can become the mainstream currency of the future. And the debate often focuses on the deflationary nature of bitcoin.

Many bitcoiners are attracted by the fact that bitcoin cannot be increased at will. In contrast to the attitude of bitcoiners, economists are polarized over the 21 million fixed total of bitcoin.

Economists of the Keynesian school believe that governments should actively regulate monetary aggregates, using monetary policy loosening and tightening to fuel or brake the economy at the right time. Thus, they believe that a fixed-aggregate bitcoin currency sacrifices controllability and, worse, will inevitably lead to deflation, which in turn hurts the overall economy. Austrian school economists argue the opposite, that the less government intervention in the currency, the better, and that deflation caused by a fixed aggregate currency is no big deal, and even a sign of social progress.

The Bitcoin network generates new bitcoins by "mining" them. Mining" is essentially the use of computers to solve a complex mathematical problem to ensure the consistency of the Bitcoin network's distributed bookkeeping system. The Bitcoin network automatically adjusts the difficulty of the math problem so that the entire network gets a qualified answer about every 10 minutes. The Bitcoin network then generates a new amount of bitcoins as a block reward for getting the answer.

In 2009, when Bitcoin was created, the block reward was 50 Bitcoins. 10 minutes after its birth, the first 50 bitcoins were generated, and the total amount of money at that point was 50. Bitcoins then grew at a rate of about 50 every 10 minutes. When the total reaches 10.5 million (50% of 21 million), the block reward is halved to 25. When the total reached 15.75 million (50% of the new output of 5.25 million, or 10.5), the block bonus was halved again to 12.5. The cryptocurrency system had only no more than 10.5 million for four years, after which the total number will be permanently limited to about 21 million.

Bitcoin is a virtual currency that is limited in number but can be used to cash out: it can be exchanged for most countries' currencies. You can use bitcoins to buy virtual items, such as clothes, hats, and equipment in online games, or you can use them to buy real-life items as long as someone accepts them.

On February 25, 2014, the opening price of bitcoin on "Bitcoin China" was 3,562.41 yuan, and by 4:40 p.m., the price had fallen to 3,185 yuan, a drop of more than 10%. According to the platform's historical data, on Jan. 27, 2014, 1 bitcoin could be exchanged for 5,032 yuan. This means that in less than a month on the platform, the price of bitcoin has fallen by 36.7%.

On September 9 of the same year, U.S. e-commerce giant eBay announced that Braintree, the company's payment processing subsidiary, would begin accepting bitcoin payments. The company has entered into a partnership with bitcoin trading platform Coinbase to begin accepting this relatively new means of payment.

While eBay's marketplace trading platform and PayPal business do not yet accept bitcoin payments, Braintree customers such as travel home rental community Airbnb and car rental service Uber will be able to begin accepting the virtual currency. The company was acquired by eBay in 2013 for about $800 million.

On the evening of January 22, 2017, Firecoin.com, Bitcoin China and OKCoin Coinline released announcements on their respective official websites one after another, stating that in order to further curb speculation and prevent drastic price fluctuations, each platform will start charging a transaction service fee from 12:00 noon on January 24, with the service fee charged at a fixed rate of 0.2% of the transaction amount and the same rate for active and passive transactions. on May 5, the The latest data from OKCoincoin.com shows that the price of bitcoin has just made new history again, touching a high of RMB 9,222 by press time. on January 24 at 12:00 noon, China's three largest bitcoin platforms officially began charging transaction fees. on September 4, the central bank and seven other ministries issued an announcement that China was banning virtual currency trading. On December 17 of the same year, Bitcoin reached an all-time high of $19,850.

On November 25, 2018, bitcoin fell below the $4,000 mark before stabilizing at more than $3,000. on November 19, the cryptocurrency resumed its decline, with bitcoin dipping below the $5,000 mark for the first time since October 2017, due to a previous hard fork in BCH and increased regulatory scrutiny of initial token offerings (ICOs). at 4:30 a.m. on November 21, the Bitcoin quotes on the coinbase platform fell below $4,100, hitting a 13-month low.

In April 2019, bitcoin broke the $5,000 mark again, hitting a new high for the year. On May 12, bitcoin broke through $7,000 for the first time in nearly eight months. on May 14, bitcoin stood at $8,000, up 14.68% in 24 hours, according to coinmarketcap quotes. on June 22 , the price of bitcoin broke through the $10,000 mark. Bitcoin price oscillated around $10,200, up nearly 7% in 24 hours. on June 26, the bitcoin price broke through $12,000 in one fell swoop, hitting a nearly 17-month high since January 2018. in the morning of June 27, the bitcoin price was once close to $14,000, hitting another new high for the year.

On Feb. 10, 2020, bitcoin broke through $10,000. According to trading data, the price of bitcoin rose above 3% .On March 12, according to cryptocurrency trading platform Bitstamp data, the lowest price of bitcoin had fallen to $5,731 at 19:44.On May 8, bitcoin broke through the $10,000 barrier, hitting a new high since February .Starting at 8:00 a.m. on May 10, the single price of bitcoin dropped in half an hour from $9,500 The price of bitcoin instantly dropped by thousands of dollars within half an hour, with the lowest price falling below $8,200 and the highest spread exceeding $1,400. at 6 p.m. on July 26, bitcoin pulled up very quickly in the short term, touching a high of 10,150.15USDT, with a maximum intraday gain of more than 4%, the first time it had broken through the $10,000 barrier since June 2, 2020. on November 4, the price of bitcoin officially broke through On the evening of Nov. 12, the bitcoin price broke through $16,000, setting a new high since January 2018, up more than 8.6% for the week. The total market value of bitcoin exceeded $291.5 billion. on November 18, the price of bitcoin broke through $17,000 . on December 1, the price of bitcoin was reported at $19,455.31, up 5.05% in 24 hours. on December 17, the price of bitcoin broke through the $23,000 integer barrier, setting a new record high, up more than 7.5% during the day. As of 19:20 on December 27, Bitcoin was quoted at $28,273.06.

On January 8, 2021, Bitcoin rose above the $40,000 mark, peaking at $40,402. On February 16, Bitcoin hit another record high, rising above $50,000 per coin. on February 17, according to AFP London, the virtual currency broke through the $50,000 mark for the first time on February 16 local time after some heavyweight companies backed Bitcoin after it appreciated nearly 75 percent in 2021. the $50,000 mark. At approximately 12:35 p.m. GMT, Bitcoin appreciated 4.4% from the previous day to reach a new all-time high of $50,547.70.

On February 16, 2021, the bitcoin price surpassed $50,000. on February 20, 2021, bitcoin's total market cap surpassed the $1 trillion mark. on February 22, 2021, the bitcoin price broke through $58,000 per coin on the line. on the evening of February 22, 2021, bitcoin's decline was extended by a shorting fund backlash, and once fell below $48,000 per coin during the day, a decline that expanding to nearly 17%. Subsequently, long funds quickly began to bottom out, and within half an hour, bitcoin fell from 17% back to 6%. coinGecko quotes show that as of around 00:00 GMT on February 23, bitcoin was quoted at $52,878.42 per coin, currently down 9% in 24 hours. on March 3, bitcoin rose over 5% intra-day to stand at $51,000 per coin. [39] On March 13, Bitcoin rose about 6% in 24 hours to stand at $60,000 per coin, with a market cap of about $1.1 trillion.

On May 19, 2021, Bitcoin's decline extended to 18%, falling below the $35,000 per coin round number mark and breaking nine consecutive $1,000 hurdles during the day.

In June 2021, El Salvador passed the "El Salvador Bitcoin Law", a bill stating that Bitcoin would become legal tender in the country, which took effect ninety days after it was published in the Official Gazette. on September 7, the bill took effect and Bitcoin officially became legal tender in El Salvador, making it the first country in the world to grant legal status to digital currency.

On September 24, 2021, the People's Bank of China issued a notice to further prevent and dispose of the risk of speculation in virtual currency trading. The notice stated that virtual currencies do not have the same legal status as legal tender.

In October 2021, Bitcoin regained its position above the $50,000 per coin mark, hitting a new high since September 7. As of October 20, Bitcoin hit a new record high after six months, rising above $65,000 per coin, up 1.16% intraday.

On November 9, 2021, Bitcoin hit another all-time high during the trading session, surpassing $67,000 per coin for the first time. On November 9, Bitstamp platform quotes showed Bitcoin reaching $68,065.30 per coin, after having peaked at $68,564.40 per coin within the past 24 hours. [56] On November 13, Bitcoin surpassed Facebook and Tencent in market capitalization, squeezing into the world's top five. on November 10, the price of Bitcoin hit another record high, approaching $69,000 per coin for the first time.

In January 2022, Bitcoin continued its decline on Friday, falling below $42,000 and touching levels not seen since September 2021.

On the evening of January 22, 2022, Bitcoin fell below $36,000 per coin at one point during the day, dropping a maximum of 12.8%.

On March 1, 2022, the U.S. Treasury Department issued new rules prohibiting U.S. persons from providing any support to Russian oligarchs and entities, including through the use of digital currencies or crypto assets for transactions, which took effect on March 1, according to Bloomberg. On the same day the new rules were issued, the price of bitcoin pulled up briefly, spiking directly from around $41,800 to near $44,000, a 24-hour gain of more than 14%.

On March 24, 2022, Pavel Zavalny, Chairman of the Russian State Duma's Energy Committee, stated at a press conference that Russia is willing to accept bitcoin as a form of payment for its natural resource exports.

On May 27, 2022, Tesla CEO Elon Musk said that Tesla's peripheral products could be purchased with dogcoins. In September, Bitcoin rose 6.1% at one point, with the price crossing the $20,000 mark.

On February 2, 2023 it was reported that Bitcoin broke through $24,000 per coin, renewing its previous high.

In February 2023, the International Monetary Fund developed a nine-point action plan on how countries should treat crypto assets, the most important of which was to "preserve the sovereignty and stability of currencies by strengthening the monetary policy framework and not granting official or legal tender status to cryptocurrencies such as Bitcoin.

III. Bitcoin currency exchange

1、Purchase method

Users can buy bitcoins, but they can also use a computer to "mine" bitcoins by performing a large number of operations according to an algorithm. When a user "mines" bitcoins, he or she uses a computer to search for 64-bit numbers and then competes with other gold miners by repeatedly solving puzzles to provide the bitcoin network with the numbers it needs, and if the user's computer successfully creates a set of numbers, he or she will receive 25 bitcoins.

Because of the decentralized programming of the Bitcoin system, only 25 Bitcoins can be earned in every 10 minutes, and by 2140, the maximum number of Bitcoins in circulation will be 21 million. In other words, the Bitcoin system is capable of self-sufficiency, coded to withstand inflation and prevent others from tampering with these codes.

2. Transaction Methods

Bitcoin is electronic cash, similar to email, and requires an email-like "bitcoin wallet" and an email-like "bitcoin address" for both parties to the transaction. Like sending and receiving emails, the party sending the money pays the recipient directly via computer or smartphone at the recipient's address. The following table lists some of the websites where bitcoin wallets and addresses can be downloaded for free.

A bitcoin address is a string of letters and numbers about 33 digits long, always starting with 1 or 3, for example, "1PCgrJSzxJTjtUUUbijcvPjZ6FVS2jGeZnN" for Firecoin. The Bitcoin software can generate addresses automatically and does not require an internet connection to exchange information when generating addresses, it can be done offline. There are a large number of available bitcoin addresses.

Bitcoin addresses and private keys come in pairs, and their relationship is like that of a bank card number and a password. A bitcoin address is used like a bank card number to keep track of how many bitcoins you have at that address. You can generate as many bitcoin addresses as you like to store your bitcoins. When each bitcoin address is generated, a corresponding private key is generated for that address. This private key proves that you have ownership of the bitcoins at that address. We can simply think of a bitcoin address as a bank card number, and the private key for that address as the password for the corresponding bank card number. You can only use the money on the bank card number if you know the bank password. So, please keep your address and private key when using your Bitcoin wallet.

A transaction is initially confirmed when the bitcoin transaction data is packaged into a "block" or "block". The transaction is further confirmed when the block is linked to the previous block. After six consecutive block confirmations, the transaction is essentially irreversibly confirmed. The Bitcoin peer-to-peer network stores all transaction history in a "blockchain". The blockchain is continuously extended, and once a new block is added to the blockchain, it is not removed. The blockchain is actually a decentralized group of user-side nodes and a distributed database of all participants, a record of the history of all Bitcoin transactions. Satoshi Nakamoto expected that as the volume of data increased, the user side would want this data not to be stored entirely in their own nodes. To achieve this goal, he uses the introduction of a hash function mechanism. This way the user side will be able to automatically weed out the parts that they will never use, such as some of the very early bitcoin transaction records.

3. Spending Methods

Many websites for tech players have started accepting bitcoin transactions. For example, sites like Firecoin, Cryptocurrency, OKEx, and certain stores on Taobao can even accept bitcoin for dollars and euros. There is no doubt that Bitcoin has become a real circulating currency, not a virtual currency like Tencent Q-coin. There are already specialized bitcoin third-party payment companies abroad, similar to Alipay in China, that can provide API interface services.

You can buy bitcoins with money, or you can be a miner and "mine" them by using a computer to search for 64-bit numbers. By using the computer to repeatedly decrypt and compete with other gold miners, it provides the bitcoin network with the numbers it needs. If the computer can successfully create a set of numbers, it will receive 12.5 bitcoins. Bitcoins are decentralized and require the creation of a fixed number of bitcoins per unit of computing time is 12.5 bitcoins available every 10 minutes. By 2140, the maximum number of bitcoins in circulation will be 21 million. In other words, the bitcoin system is self-sustaining, translating into a code that can withstand inflation and prevent others from messing with it.

4、Payment Cases

While being wildly pursued by investors, Bitcoin has been accepted in reality by individual merchants. One restaurant in Beijing has turned on bitcoin payments. The restaurant, located in Chaoyang Joy City, says it began accepting bitcoin payments in late November 2013. Consumers transfer a certain amount of bitcoin to the restaurant's account at the end of their meal to complete payment, a process similar to a bank transfer. The restaurant has settled a $650 meal for 0.13 bitcoins.

In January 2014, Overstock became the first major online retailer to accept bitcoin.

The "world's first" Bitcoin ATM was opened in Vancouver, Canada on October 29, 2013 to exchange Canadian dollars for Bitcoin, and quickly saw crowds lining up to do so.

"World's First"

The ATM was manufactured by Machine Money Inc. and is located in a Vancouver coffeehouse called "Trendy".

One of the ATM owners is Mitchell Demeter, who has been trading bitcoin for several years, and two other high school classmates who set up a bitcoin trading company in partnership. Demeter says this is the world's first bitcoin ATM.

Demeter and his companions saw the Bitcoin ATM as a business opportunity because previously "there were no Bitcoin ATMs, everyone was trading on websites.

To operate, bitcoin users enter a password similar to a bank PIN to log into their online bitcoin account.

Through the ATM, users can withdraw cash from their Bitcoin account in Canadian dollars corresponding to the ratio, or they can deposit cash into their Bitcoin account.

Bitcoin users only need a smartphone to use bitcoin, similar to the online shopping format.

Lack of Regulation

But some fear that bitcoin is becoming a hotbed for drug dealing, money laundering and other illicit activities. A website called Silk Road, which set up a platform for unscrupulous people to trade in bitcoin, was shut down by U.S. authorities earlier this month. U.S. police said on Oct. 25, 2013, that they found $2.8 million worth of bitcoins on the computer of the site's owner, Ross William Ulbrich.

Reuters reported that the website had been operating since 2011 and had built a trading platform for unscrupulous individuals. The site has heroin and other drugs for sale, and even offers killers. More than 900,000 registered users of the site used bitcoin to make drug deals. Court documents show the site struck $1.2 billion worth of bitcoin transactions in two years of operation, charging between 8 and 15 percent in fees for each transaction.

AFP reports that Bitcoin is not yet effectively regulated in any country or region. Germany is the first country in the world to recognize bitcoin as a "private currency.

IV. Bitcoin generation principle

Bitcoins are issued by a system that automatically generates a certain number of bitcoins as a reward for miners. Miners act as the currency issuer here, and the process by which they obtain bitcoins is also known as "mining". All bitcoin transactions are mined by miners and recorded in this ledger. Mining is actually a series of algorithms that are used to calculate the required hash value to gain access to the ledger. This process is actually trial and error, the more random hash collisions a computer generates per second, the higher the probability of calculating the correct hash value first. The first miner to calculate the correct value gets to pack the bitcoin transaction into a block, which is then recorded across the blockchain, and thus rewarded with the corresponding bitcoin. This is how Bitcoin is issued, and it also incentivizes miners to maintain the security and tamper-evident nature of the blockchain.

The designers set the total number of bitcoins at 21 million at the beginning of the design. Initially each miner who fought for the right to keep the ledger received 50 bitcoins as a reward, which was halved every four years thereafter. It is expected that by 2140, Bitcoin will no longer be able to continue to be subdivided, thus completing the issuance of all currencies, and no more will be added after that.

V. Bitcoin Features

1. Decentralization: Bitcoin is the first distributed virtual currency where the entire network consists of users and there is no central bank. Decentralization is the guarantee of Bitcoin's security and freedom.

2. Worldwide circulation: Bitcoin can be managed on any computer with Internet access. Anyone can mine, buy, sell or receive bitcoins no matter where they are located.

3. Exclusive Ownership: Private keys are required to manipulate Bitcoin, and it can be kept in isolation on any storage medium. No one can access it except the user themselves.

4, Low transaction fees: Bitcoins can be remitted for free, but eventually a transaction fee of about 1 bit cent will be charged for each transaction to ensure faster execution of the transaction.

5, No hidden costs: As a means of payment from A to B, Bitcoin has no cumbersome limits on amounts and procedures. Payments can be made by knowing the other party's bitcoin address.

6, Cross-platform mining: Users can tap into the computing power of different hardware on numerous platforms.

7, bitcoin advantages

Completely decentralized, there is no issuer, and it is impossible to manipulate the number of issues. Its issuance and circulation, is achieved through open source P2P algorithm.

Anonymous, tax-free, and regulation-free.

Robustness. Bitcoin is completely dependent on the P2P network with no issuance center, so it cannot be shut down externally. Bitcoin's price may fluctuate, crash, and multiple governments may declare it illegal, but Bitcoin and Bitcoin's vast P2P network will not go away.

Borderless and cross-border. To send money across borders, it goes through layers of exchange control agencies, and the transaction history is recorded by multiple parties. But if you trade with Bitcoin, you simply enter a digital address, click your mouse, wait for the P2P network to confirm the transaction, and a large amount of money goes over. It doesn't go through any control bodies and doesn't leave any cross-border transaction records.

It is difficult for cottagers to survive. Since the Bitcoin algorithm is completely open source, anyone can download the source code, modify some parameters, recompile it, and create a new P2P currency. But these cottage currencies are vulnerable and extremely susceptible to 51% attacks. Any individual or organization that controls 51% of the computing power of a P2P currency network can manipulate transactions and currency values at will, which can be a devastating blow to P2P currencies. Many cryptocurrencies die on this link. The Bitcoin network is robust enough that the number of CPUs/GPUs needed to control 51% of the computing power of the Bitcoin network would be astronomical.

8. Bitcoin Disadvantages

The vulnerability of the trading platform. The Bitcoin network is robust, but the Bitcoin trading platform is fragile. A trading platform is usually a website, and websites can be hacked or shut down by authorities.

Long transaction confirmation times. When a bitcoin wallet is first installed, it consumes a lot of time downloading blocks of historical transaction data. And when bitcoin is traded, some time is consumed to confirm the accuracy of the data, interact with the P2P network, and get network-wide confirmation before the transaction is considered complete.

The price is extremely volatile. The large number of speculators involved has caused the price of bitcoin for cash to rise and fall like a roller coaster. Makes bitcoin more suitable for speculation than anonymous trading.

Lack of understanding of the principles by the general public, and resistance from traditional financial practitioners. Active internet users understand the principles of P2P networks and know that Bitcoin cannot be manipulated or controlled by humans. But the public doesn't understand, and many can't even tell the difference between Bitcoin and Q-coin. "The "no issuer" aspect of Bitcoin is an advantage, but in the eyes of traditional finance practitioners, a currency with no issuer is worthless.

VI. Bitcoin's status in various countries

Germany: At the end of June 2013, the German Parliament decided that bitcoin would be tax-free after being held for more than a year, and bitcoin was recognized as a "unit of account" by the German Ministry of Finance, which means that bitcoin is now considered legal tender in Germany and can be used to pay taxes and engage in trade activities.

U.S.: In August 2013, U.S. District Court Judge Amos Mazzant of Texas ruled in a case involving a bitcoin virtual hedge fund that bitcoin is a currency and should be regulated under financial regulations.

Japan: In 2017, the Japanese government said bitcoin is a legal form of payment.

Pakistan: on January 12, 2022, Indian newspaper Toras news reported that the State Bank of Pakistan and the federal government have decided to ban the use of all cryptocurrencies, according to a report submitted to the Sindh High Court (SHC) during a hearing of a case regarding digital currencies, according to Pakistan's SAMAA TV.

Singapore: January 19, 2022 Reuters reports that cryptocurrency automated teller machines (ATMs), which provide a convenient platform for trading digital tokens, are being taken offline in Singapore as the Monetary Authority of Singapore (MAS) restricts consumer advertising of cryptocurrencies. Cryptocurrency ATMs enable users to trade digital payment tokens such as bitcoin and ethereum in legal tender or government-issued currency.

Thailand: On March 23, 2022, the Union-Tribune reported that Thailand will ban the use of cryptocurrencies as a payment method for goods and services, saying the widespread use of digital assets threatens the country's financial system and economy.

Indonesia: In April 2022, an Indonesian tax official said the country plans to impose a value-added tax on crypto asset transactions and a 0.1% income tax each on capital gains from such investments from May 1 amid booming digital asset trading, Reuters reported.

Russia: On March 24, 2022, Russia is considering accepting bitcoin as a payment method for its oil and gas exports in the face of expanding Western sanctions, said Zavarni, chairman of the State Duma's energy committee .

China: In China, the RMB Regulation prohibits the production and sale of token vouchers. As there is no clear judicial interpretation of the definition of token coupons, Bitcoin's legal future in China faces uncertainty if Bitcoin is included in "token coupons".

Hong Kong, China: The Hong Kong Securities and Futures Commission (SFC) proposed a plan on February 20, 2023 to allow retail investors to trade digital tokens such as bitcoin and ethereum. In a consultation paper, the SFC in Hong Kong said it proposes to allow retail investors to trade large-cap tokens on exchanges licensed by the SFC, provided that safeguards such as knowledge tests, risk tolerance assessments and reasonable exposure limits are in place .

On June 9, 2021, the Salvadoran parliament passed a bill approving bitcoin as legal tender in the country, which officially took effect 90 days later on September 7.

On September 6, 2021, El Salvador's President Buerkle announced via social networks that the government had purchased a total of 400 bitcoins in two separate purchases that day, worth approximately $21 million at current market rates.

In September 2021, the Cuban Central Bank (BCC) issued its Resolution No. 215 of 2021 recognizing the entry into force of cryptocurrencies such as Bitcoin. Cryptocurrencies are now a legal form of payment for commercial transactions in Cuba.

In 2022, the National Assembly of the Central African Republic unanimously passed a bill to make Bitcoin legal tender.

Related Article

-

Bitcoin Brief Development History and Future Trends

-

Bitcoin Woods: Bitcoin Halves With Less Than 50,000 Blocks Left

-

A quarter out of $2.2 billion BTC, Twitter's former CEO of the company how to "muffled earnings"?

-

The Fed is done raising rates, U.S. stocks will rise Bitcoin has a "real problem"

-

From Meme to Encryption: Exploring the Evolution and Risk Challenges of PEPE

-

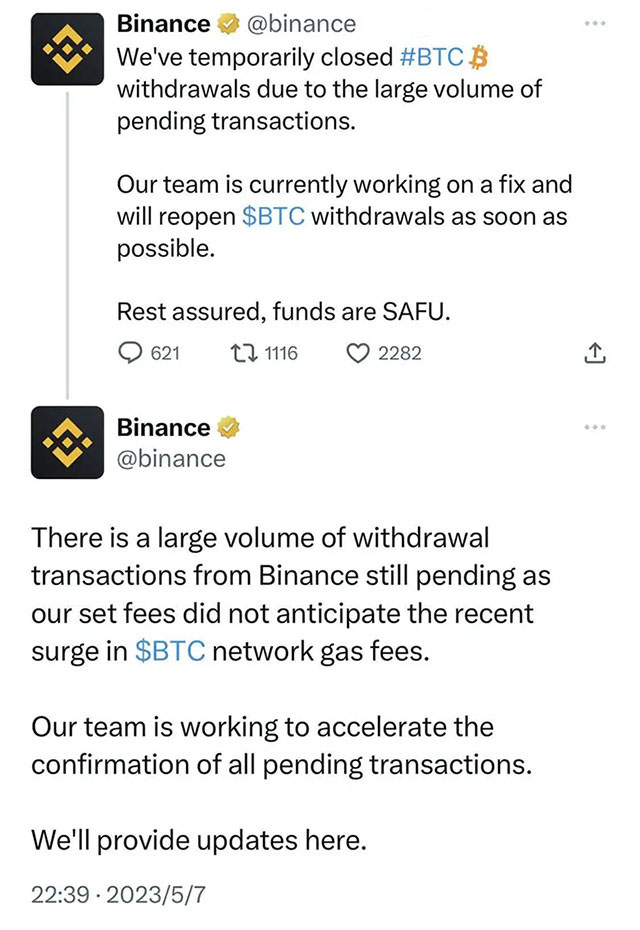

Coin Security Suspends Bitcoin Withdrawals Twice in One Day Due to Huge Coin Withdrawal Transactions