Bitcoin price dive 70,000 people overnight explosion, more than 1.7 billion yuan evaporated!

Bitcoin plummeted, 24 hours worldwide more than 70,000 people directly exploded! The entire $249 million went up in smoke overnight!

In the evening of April 21, local time in the United States, the price of bitcoin suddenly dived, a short dip of nearly $ 1,000, fell below the important support level of $ 28,000.

Bitcoin price dives 70,000 people exploded overnight and over $249 million evaporated!

At the same time, the U.S. Securities and Exchange Commission, Commodity Futures Trading Commission and other agencies continue to tighten regulation of the virtual currency industry, triggering pessimistic speculation about the future of the virtual currency industry in the market.

The virtual currency market took a shocking dive

The virtual currency market continued to fall this week, pulling back from the previous $30,000 round number mark, and was particularly sold off continuously throughout the day on April 20, with bitcoin falling more than 5% at one point to $28,500.

According to futures data provider Coinglass, as of 12 p.m. BST on April 22, 74,962 people had exploded their positions in the last 24 hours, and $249 million in funds had evaporated.

The cryptocurrency super-rich have also seen their fortunes shrink significantly under the collapse of the virtual currency industry.

Data released by Forbes last week showed that billionaires in the global virtual currency industry lost a combined $110 billion (about RMB 760 billion) in 2022.

The trigger for the rapid evaporation of the fortunes of these super-rich was the back-to-back meltdowns of Luna coin and cryptocurrency exchange FTX last year, triggering a global virtual currency jolt that once plunged the market into pessimism, with bitcoin prices falling to $15,600 per coin in 2022, the largest drop of 70% in the year.

As of March 10, 2023, the total assets of the richest people in the global virtual currency industry rich list shrunk from approximately $140 billion to less than $30 billion. In addition, a "bloodbath" in 2022 resulted in the number of billionaires in the global virtual currency industry dropping from a record 19 to just nine.

Currently, Zhao Changpeng, co-founder and CEO of the world's largest virtual currency trading platform, Cryptocurrency, is still number one on the global virtual currency billionaire list. According to Forbes, Zhao Changpeng's wealth has fallen to $10.5 billion from $65 billion in 2022.

In the past year or so, virtual currencies have gone from being the world's most upside asset to the world's most junk asset.

Why such a big shift?

Because, the easier it is for an asset to skyrocket, the easier it is for it to plummet.

A man named James in the United States mined 7,500 bitcoins through his computer early on, then disassembled the computer's parts and threw the hard drive in the trash by mistake.

At the same time James threw away the hard drive, the price of bitcoin began to skyrocket.

In 2017, bitcoin came to an all-time high of nearly $20,000.

That's nearly a 200-fold increase from when James lost it.

This is the most tragic story I've ever heard of losing my "freedom of wealth.

In October 2009, the first dollar-to-bitcoin exchange rate was released by the New Freedom Standard.

One dollar equals 1309 bitcoins, which means that one dollar can buy 1309 bitcoins, and one bitcoin is worth only $0.00763.

In February 2011, Bitcoin and the US dollar had one price, and one Bitcoin was equal to one US dollar.

On April 1, 2013, the price of Bitcoin passed $100 a piece.

On October 13, 2017, the price of Bitcoin crossed $5,000.

By November 10, 2021, Bitcoin reached an all-time peak of $68,928.90 U.S. coins.

The highest increase in Bitcoin since its inception has been over 50 million times.

The bigger the bubble, the closer it is to bursting.

After the price peaked bitcoin began a steady decline, falling below $60,000, $50,000, $40,000, $30,000 in succession ....... It went from a high of over $68,000 a piece, then to the current $28,000 a piece.

If you compare that to the $68,000 peak in 2021, that equates to a 70% plunge in bitcoin!

Although this round of plunge, although not as fierce and tragic as a year ago, but the impact is more far-reaching, and more significant::

What's scarier than a plunge is a negative fall, and what's scarier than a quick cut is a slow cut.

Zero-sum game under the riches and bankruptcy

Many people only see others skyrocketing and making money speculating in coins! Those who are more, losing money, even forced to jump, but turn a blind eye.

You must be clear that any market involving virtual currency trading has one of the most obvious laws: it's just like gambling, some people win, naturally some people lose. How much you win, how many losers you naturally have!!!

Winning money everyone always easy to remember, those who lost money, lost a point, instead of no one see!

If you take a moment to think about it:

One side is sitting on countless wealth of capitalists, with a variety of virtual coins, ready to burst into the burst out, control the price of virtual coins of the banker.

On the other side are ordinary people like you, ordinary investors. Who do you think will be the winner? Who will win when you gamble together?

It's obvious! Those Western capitalists who have a large amount of virtual coins. They can manipulate the "trading volume" at will! To control the "price" up or down!

These people are definitely the big winners. They want to make money, from where? The most important thing is to cut the leeks of the global retail investors.

In the financial market, which has always been regarded as a high-end field, when you see the market buying bitcoin, you buy bitcoin with your own money, and in the countryside, when you see others making a lot of money growing corn, the next year the whole village grows corn, which is essentially the same thing: the layout of the banker, the harvest of strength, and the blood loss of the followers.

In fact, the truth is that the long rise will fall, where all applicable, stocks, real estate, and even virtual coins are also the same.

Sometimes people feel that they are losing money because of the market conditions, but not actually.

The market will not favor anyone, people are ultimately lost to the desire, lost to human nature.

Translated with www.DeepL.com/Translator (free version)

Related Article

-

Bitcoin Brief Development History and Future Trends

-

Bitcoin Woods: Bitcoin Halves With Less Than 50,000 Blocks Left

-

A quarter out of $2.2 billion BTC, Twitter's former CEO of the company how to "muffled earnings"?

-

The Fed is done raising rates, U.S. stocks will rise Bitcoin has a "real problem"

-

From Meme to Encryption: Exploring the Evolution and Risk Challenges of PEPE

-

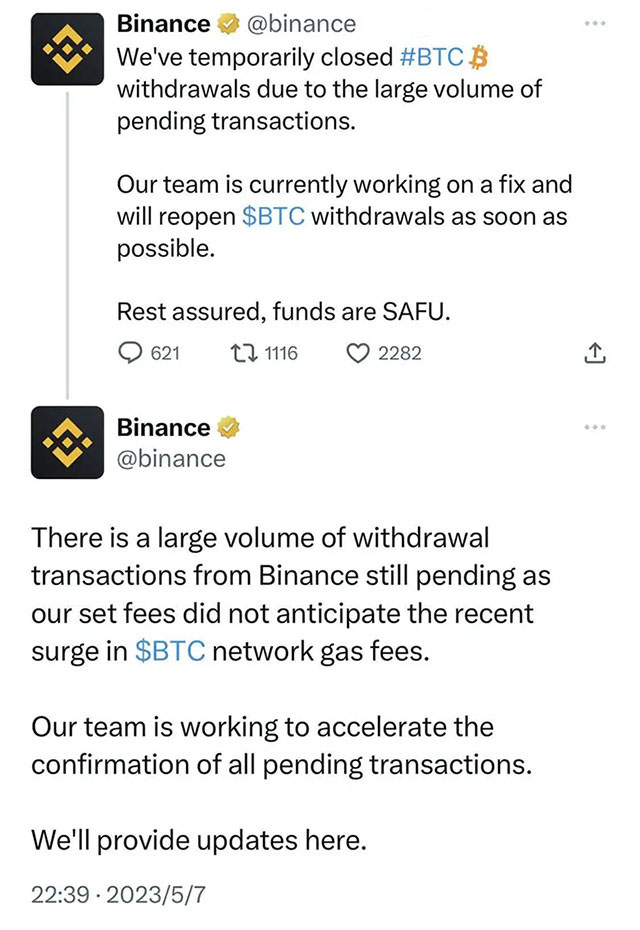

Coin Security Suspends Bitcoin Withdrawals Twice in One Day Due to Huge Coin Withdrawal Transactions