On the first anniversary, Intel announced to stop production of bitcoin mining series chips

On April 19, semiconductor giant Intel officially announced the end of the life cycle of its bitcoin mining series of chips and did not announce any successor chips, according to Tom's Hardware.

Intel said, "Due to priority investments in IDM 2.0, we have ended the lifecycle of the Intel Blockscale 1000 series ASICs while continuing to support customers of Blockscale products."

The company also confirmed in a statement to foreign media outlet CoinDesk on Tuesday that it would stop producing its bitcoin mining series of chips. A document on its official website shows that it will no longer accept any related orders after Oct. 20, 2023, and that the last product will be shipped no later than April 20, 2024.

In March 2022, Intel senior vice president Raja Koduri had officially announced the company's entry into the crypto mining industry, saying that Intel chips would perform more than 1,000 times better than mainstream GPUs that mine based on the SHA-256 algorithm. According to its announcement, Intel's first customers include BLOCK (formerly Square, helmed by Twitter founder CEO Jack Dorsey), Argo Blockchain and GRIID Infrastructure.

Raja Koduri also said that Intel created a custom computing group within its AXG Graphics division to support Bitcoin ASICs and "other emerging technologies. However, Intel reportedly recently restructured the AXG group and Raja Koduri left the company shortly thereafter.

Intel's entry was once seen as a way to shake up Bitmain and Bitmicro's monopoly on bitcoin mining chips, but after only a year, Intel has abandoned the market, saying it will "continue to watch the market.

Recently, as PC and server demand continues to deteriorate, Intel's performance has suffered a shock. Its latest financial results show that the fourth quarter of 2022 revenue fell 28% year-on-year to $ 14 billion, hitting the lowest level of quarterly revenue since 2016, net profit fell 92% year-on-year to $ 400 million, far below market expectations.

Related Article

-

Bitcoin Brief Development History and Future Trends

-

Bitcoin Woods: Bitcoin Halves With Less Than 50,000 Blocks Left

-

A quarter out of $2.2 billion BTC, Twitter's former CEO of the company how to "muffled earnings"?

-

The Fed is done raising rates, U.S. stocks will rise Bitcoin has a "real problem"

-

From Meme to Encryption: Exploring the Evolution and Risk Challenges of PEPE

-

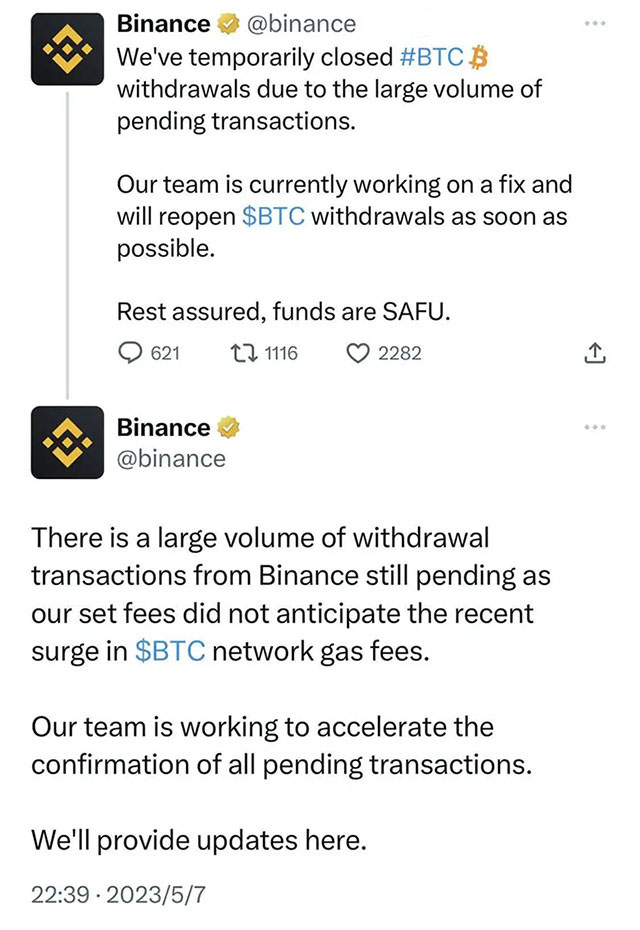

Coin Security Suspends Bitcoin Withdrawals Twice in One Day Due to Huge Coin Withdrawal Transactions