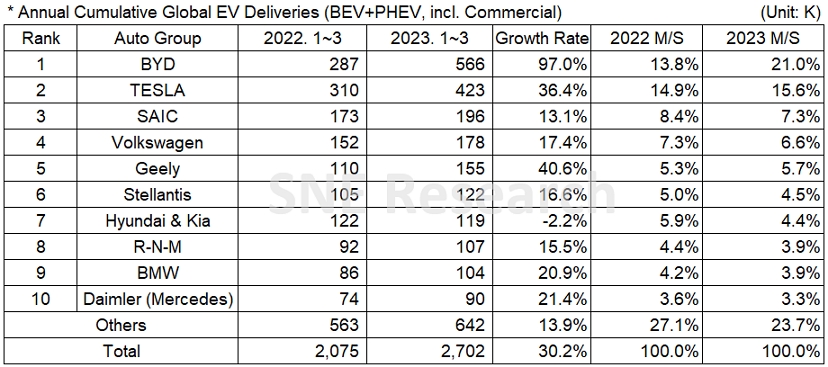

About 2.702 million new energy vehicles registered worldwide in the first quarter

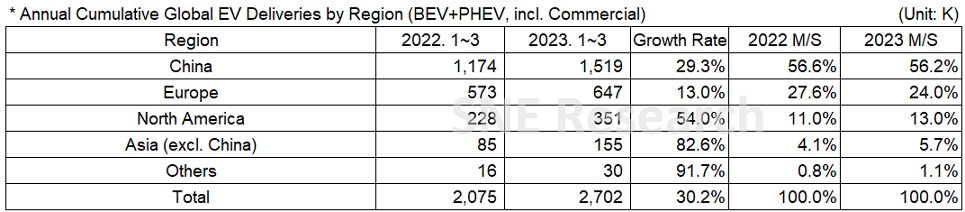

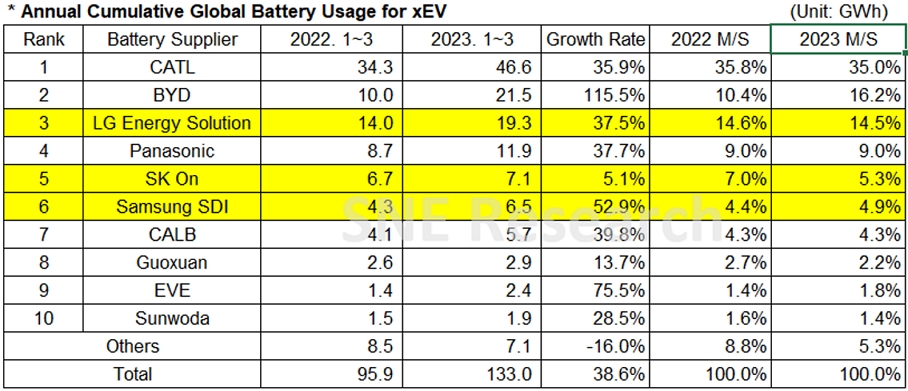

On May 3, data released by South Korean market research firm SNE Research showed that in the first quarter of 2023, the total number of new energy vehicles registered in various countries around the world was about 2.702 million, up 30.2% year-on-year, and the global vehicle power battery installation was about 133.0 GWh, up 38.6% year-on-year.

In terms of new energy vehicle sales in the first quarter of 2023, three of the top 10 global sales companies are from China, with BYD, SAIC and Geely Holding Group ranking 1st, 3rd and 5th globally. Tesla ranked second, but its pure electric sales were higher than BYD's, ranking first. In addition, the top 10 also includes major European manufacturers such as Volkswagen, Stellantis, BMW and Mercedes-Benz, as well as Hyundai Kia and Renault-Nissan Alliance in South Korea.

BYD topped the list with 97.0% year-over-year growth, reaching 566,000 units sold and a global market share of 21.0%, maintaining its explosive growth momentum, with the company's net profit up over 400% year-over-year.

Tesla also achieved 36.4% year-over-year growth in the first quarter, with global sales of 423,000 units and a market share of 15.6%. However, the increase in Tesla's sales was associated with its price cuts, but this decision also resulted in a 24.0% decrease in Tesla's net profit compared to the same period last year.

SAIC was in third place, with main sales models including Wuling Hongguang MINI EV, MG Mulan and MG ZS. However, SAIC's new energy sales increased by only 13.1% year-on-year, and its global market share saw a slight decline compared to the same period last year.

By region, of the 2.702 million new energy vehicles sold worldwide in the first quarter of this year, 1.529 million came from China, accounting for 56.2%. Europe and North America sold 647,000 and 351,000 new energy vehicles in the first quarter, respectively.

SNE Research points out that with the U.S. and Europe raising trade barriers in the form of the Inflation Reduction Act (IRA) and the European Critical Raw Materials Act (CRMA) to nurture domestic companies, local companies in each region (BYD in China, VW in Europe, and Tesla in North America) are expected to continue to maintain strong growth momentum.

While China, the U.S. and Europe are in the battle for new energy vehicles, the competition in the battery industry is still mainly concentrated among Chinese, Japanese and Korean companies.

In the first quarter of this year, China's leading power battery company Ningde Time installed 46.6 GWh, up 35.9% year-on-year, with a market share of 35%, a decrease of 0.8 percentage points compared with the same period last year, but the global first position is still solid.

BYD, ranked second, is the fastest-growing head battery company, with a 115.5% increase in installed volume in the first three months of this year, reaching 21.5GWh, and a significant increase in market share to 16.2% from 10.4% in the same period last year. This is mainly due to the growth of BYD's sales.

The two Chinese head battery companies took 51.2 percent of the global market share.

SNE Research said BYD has gained popularity in the Chinese market through vertical integration and by virtue of competitive pricing, and it is worth watching the changes BYD's growth may bring as it is about to enter more regions such as Europe.

Four Japanese and Korean companies were ranked 3-6 in the global power battery industry in the first quarter of this year.

Among them, three South Korean companies LG, SK On and Samsung SDI ranked 3, 5 and 6 respectively. All three battery companies showed growth overall, but their combined market share was 24.7%, down 1.3% from the same period last year.

Panasonic is the only Japanese company in the top 10, with 11.9 GWh installed in the first quarter, up 37.5% year-over-year, and maintaining the same market share as the previous year (9%). As one of Tesla's main battery suppliers, Panasonic's batteries are mainly installed in Tesla models in the North American market.

Companies from China, including Sinova, Guoxuan High Tech, YIWI Li-energy and Xinwanda, were ranked 7-10, with varying degrees of growth in battery installations.

SNE Research said that in the first quarter of this year, the global power battery installation volume grew 38.6%, a slight decrease in growth rate compared to last year, but still a steady upward trend. This is mainly due to the solid formation of China's electric vehicle market and the positive impact of trade protection measures announced in Europe and the United States. Based on the U.S. Inflation Reduction Act, the list of electric vehicles eligible for the tax credit includes most U.S. car companies, with the Volkswagen ID.4 being the first European vehicle to be included on the list.